By

The first marijuana hearing of the 116th Congress kicked off on Wednesday. A House financial subcommittee asked witnesses about how banking access can improve public safety, how operating on a cash-only basis inhibits transparency and, at one point, whether the cash at these businesses smells like cannabis.

“The absence of a broader, permanent regulatory framework continues to keep nearly all banks out of this growing industry despite a clear interest,” Rep. Gregory Meeks (D-NY), chair of the subcommittee, said at the start of the session. “Today’s hearing will allow us to begin consideration of draft legislation to bring transparency, accountability and address a major driver of violent crime in this space.”

Prior to the hearing, a bipartisan group of lawmakers circulated a draft bill that would shield banks from being penalized by federal financial regulators and affirm that profits from cannabis-related transactions “shall not be considered as proceeds from an unlawful activity.”

“Today, after six years, we finally have a hearing, and it comes too late,” Rep. Denny Heck (D-WA), who is a cosponsor of the the legislation, said in his opening remarks. “Too late to prevent dozens of armed robberies in my home state of Washington. Too late for Travis Mason… a 24-year-old Marine veteran in Aurora, Colorado, who reported for work as a security guard and Green Heart Dispensary on June 18, 2016, and was shot dead that night by an armed robber.”

“We have the power in this committee to prevent murders and armed robberies,” he said, referring to the fact that preventing marijuana businesses from accessing banks means that they must operate on an all-cash basis. “We must use it and we must use it now because we are already late.”

Rep. Ed Perlmutter (D-CO), another bill cosponsor, said that if lawmakers oppose legalization, “that’s their business.”

“But the American voters have spoken, and continue to speak, and the fact is you can’t put the genie back in the bottle,” he said. “Prohibition is over.”

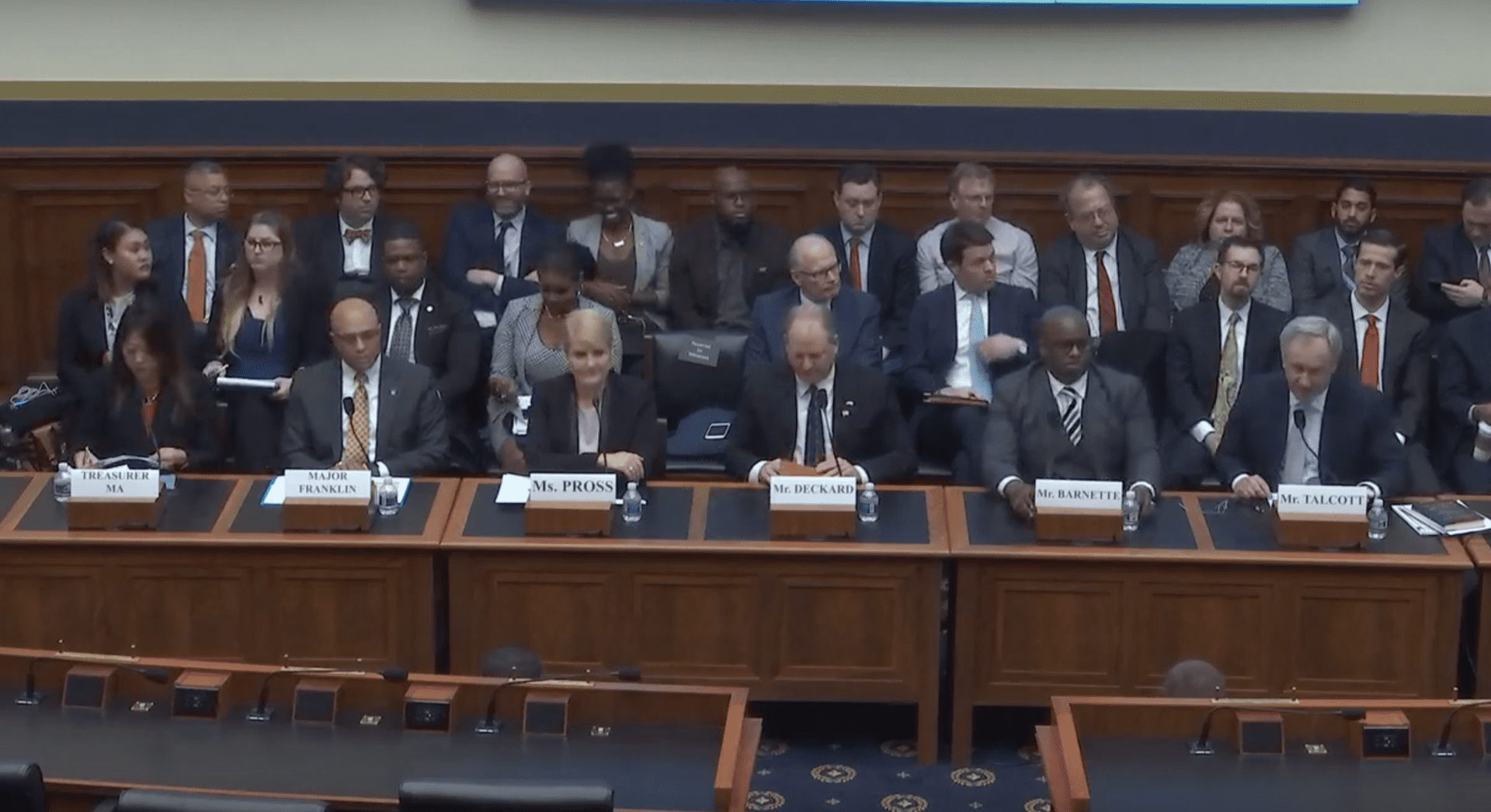

Witnesses at the hearing included California State Treasurer Fiona Ma, Law Enforcement Action Partnership (LEAP) Executive Director Major Neill Franklin, banking representatives, a D.C.-based medical marijuana dispensary owner and the chair of the anti-legalization group Smart Approaches to Marijuana (SAM).

“The Committee is undoubtedly aware that cannabis businesses are not alone in struggling to gain access to banking—even though theirs is the most difficult situation. Any business that handles significant amounts of currency is also subject to greater scrutiny by the financial services industry for all of the reasons that are well understood by members of this committee,” Ma said in written testimony.

She said “an effective safe harbor mechanism in federal law promotes the safety of the public, improves the efficiency of collecting the taxes and fees we use to regulate the industry, and does not allow the banks and credit unions to totally abdicate their responsibilities to know their customers and avoid illicit money laundering.”

Rep. Ted Lieu (D-CA) said he was glad to see Ma testify. Legal marijuana “is here to stay & entrepreneurs & consumers deserve safe banking options,” he wrote on Twitter.

Rep. Dina Titus (D-NV) echoed that point and said that Nevada “is proof that the era of marijuana prohibition is over” and that it’s “time for the federal government to start acting like it.”

Franklin, a retired Maryland police officer, said that current laws “encourage tax fraud, add expensive monitoring and bookkeeping expenses and—most importantly—leave legitimate businesses vulnerable to theft, robbery and the violence that accompany those crimes.”

“I’m not one for fear mongering—what I testify to here today is rooted in experience and research,” he said. “Any police officer who has worked the street, or investigated enough robberies, will testify to the same regarding any business forced to handle large amounts of cash.”

He told members of the subcommittee that the “safety of thousands of employees, business owners, security personnel, police officers and community members is in your hands.”

Rep. Maxine Waters (D-CA), chair of the full House Financial Services Committee, thanked Meeks for making this the first subcommittee hearing of the session and called the issue “so important.”

“So many people have been waiting on it,” Waters said before the subcommittee broke for a recess. “I appreciate it so much.”

The hearing was well-attended, as Rep. Alexandria Ocasio-Cortez (D-NY) highlighted in a tweet showing a line of people holding places in line for lobbyists and “those who can afford it pay people to hold their spot.”

During the hearing, Ocasio-Cortez asked whether providing banking access to the marijuana industry would be “compounding the racial wealth gap right now,” giving an advantage to mostly white, wealthy business owners over individuals from communities disproportionately impacted by the drug war.

Corey Barnette, the DC marijuana business owner, said he agreed that the industry as it exists today is not reflective of society as a whole, but he also argued that banking access can provide even smaller prospective business owners with means “within reach” to start a cannabis company.

During one of the lighter moments in the hearing, Rep. Rashida Tlaib (D-MI) asked Barnette whether the cash at his dispensary smelled like marijuana.

“I heard it’s true,” Tlaib said. “The money does smell, correct?”

“That has been the case in some instances,” Barnette replied.

While SAM board chair Jonathon Talcott was seldom addressed by members throughout the hearing, Rep. Roger Williams (R-TX) asked the witness whether it was “a universally accepted fact that marijuana is not a gateway drug and has no negative negative impacts to public health.”

Talcott claimed that cannabis “is very clearly a gateway drug” and peddled anecdotes about “marijuana-induced psychosis” in states that have legalized.

Heck, one of the banking bill cosponsors, addressed what’s motivated him to be an advocate for legislation on financial services solutions for the marijuana industry. He said it was his brother, who died after being exposed to herbicides while serving in the Vietnam War.

“Toward the end of his life, the only relief he could find was from the illegal consumption of marijuana,” Heck said. “I’ve always thought and lived with the irony that the same nation that asked my brother to put on a uniform and put his life at risk—in an activity that eventually did in fact take his life—held him to be criminal when he found the relief in the only way he could.”

And if creating a safeguard for banks makes it easier for marijuana businesses to provide that relief to patients, then that’s reason enough to fight for reform, Heck said.

“Congress has an opportunity to make a simple policy change that will greatly benefit communities and small businesses by approving cannabis banking reform,” Aaron Smith, executive director of the National Cannabis Industry Association, said in a press release. “Representatives Perlmutter and Heck should be commended for pushing for this hearing so that this issue can get the attention it deserves and we can move toward a sensible policy that will increase public safety and transparency in this burgeoning industry.”

Rep. Earl Blumenauer (D-OR), who released a blueprint outlining the legislative path to marijuana legalization, said in a press release that tackling “the access to banking issue” is “one of the first dominos that should fall.”

The hearing shows that Congress is “finally making progress toward addressing the irrational, unfair, and unsafe denial of regular banking services for state-legal marijuana businesses around the country,” he said.

“Today’s hearing was a big deal for the thousands of employees, businesses and communities across this country who have been put at risk because they have been forced to deal in piles of cash while Congress sticks its head in the sand,” Perlmutter, the other bill cosponsor, said in a press release. “The American voters have spoken and continue to speak, and the fact is you can’t put the genie back in the bottle. The SAFE Banking Act is focused solely on taking cash off the streets and making our communities safer, and only Congress can take these steps to provide this certainty for businesses and financial institutions across the country.”

“We listened to hours of testimony today about the dangerous position we put store owners and employees in by forcing them to do all of their business in cash. We can fix this. We don’t have to force them to operate in a way that makes it difficult to secure and track their funds,” Heck added. “Regardless of our views of marijuana use, the voters have decided in states all over this country that they want recreational and medicinal markets. To continue to do nothing to protect public safety would be negligence.”

Read more from the source: MarijuanaMoment.net

Photo courtesy of the House Financial Services Committee/YouTube.